No More Surprise Bills! How to Plan for Unexpected Expenses

4 Bank Accounts Your Family NEEDS to Achieve Financial Freedom

August 7, 2018

Slay Your Fear of Losing Money in the Stock Market

September 17, 2018Estimated Reading Time: 4 minutes

It’s 5:30 pm and you are driving home with the kids. Your check engine light comes on as your oldest is telling you about the money they need for the book fair TOMORROW and you realize you forgot to send the remaining bill balance to the dentist for the kids’ last checkup. Everything is hitting your wallet (and bank account) all at once…then you start to panic…

I have been there so many times! Just as you are getting your financial life in order and you have read article after article about saving money for emergencies, vacations, retirement and more but how? What can you do to prepare for these emergencies?

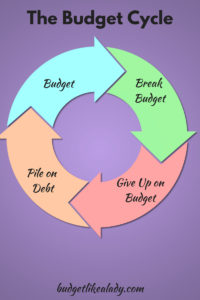

At the beginning of my budgeting days, I would break my budget ALL OF THE TIME! I would literally remake my budget every month. And when I wasn’t remaking my budget, I would just give up on budgeting all together until months later and my finances are in shambles (again) then I would start the cycle all over again.

I was tired of the never-ending cycle so I became determined to find a better way. A way that I could start planning for unexpected expenses and could still pay off debt and pay for other responsibilities. I want to give you my cheat sheet of what I set aside each month for unexpected expenses.

What is an Unexpected Expense?

My definition of an unexpected expense is “Oh, shoot! I don’t wanna pay for that!” But the real definition of unexpected expenses is bills that are not reoccurring (according to Google). This does not include the unexpected road trip with the girls. I am talking about job loss, home or vehicle repairs, medical bills and more.

So, what are we to when unexpected expenses come up? We can become pro-active and plan for unforeseen emergencies.

Planning for Unexpected Expenses

Home repairs – 1% to 3% of home value. Depending on the age of your home will depend on how much money to set aside. If you have a newer home, then usually you will have fewer repairs, so I recommend setting aside 1% of the homes’ value. If you have an older home, I recommend saving 3% of homes’ value for home repairs.

Car Repairs – $75/vehicle. Whether you have a new car or old car, I recommend setting aside at least $75 per month per vehicle. Vehicle repairs are unpredictable: a rock can hit your windshield, a random pothole can cause expensive damage, and you still have to pay your deductible to the car insurance company.

Medical Bills – $25 to $50 per person. We are a family of 4 so I set aside $200 per month for medical expenses. This covers dental and medical copays along with paying the difference for any lab work performed. This may or may not be enough for your family, but it should be a good start for unexpected medical bills. I recommend looking at the amount you spent last year in medical expenses and dividing it by 12 to get your monthly saving amount specific for your family.

Emergency Fund – 5% to 10% of monthly income. Building an emergency fund is very important. Income is not always guaranteed, and it is crucial that you save for rainy days. I recommend saving at least 5% to 10% of your income every month towards an emergency fund that should reach a total of about 3 to 6 months of expenses for your family. Job loss and big medical bills are real and unpredictable, so an emergency fund will help you be prepared.

Where to Save Your Money

After you have decided to save for unexpected expenses, the next step is to put the savings in the right bank account. DO NOT KEEP YOUR SAVINGS IN YOUR CHECKING ACCOUNT. Sorry to be so harsh but these types of expenses do not happen every day or every month, it is important to maximize your savings efforts by putting the money in a high-interest savings account. Checking account interest rates are really low and not recommend for storing savings.

Check out 4 Bank Accounts Your Family NEEDS to Achieve Financial Freedom. This post explains the different savings accounts for different savings goals.

Once I started adding these savings plans to my budget, I stopped having surprise bills come in the mail. Don’t get me wrong, bills still came in the mail, but I was prepared and those unexpected bills did not stop me from reaching my financial goals.

My emergency fund came in handy in 2014 when I lost my job. My medical fund (which I built up over time) helped me when I took unpaid maternity leave from my job when my son was born. Did you know over 40% of Americans cannot cover a $400 unexpected expense? I was shocked to read that which motivated me to write this post. I want you and your family to be prepared for emergencies, too.

How are you going to change your budget to prepare for unexpected expenses? Let me know if the comments below!

2 Comments

Great motivational read! Thank you

Glad you liked it!