Why I Refuse to Save a Lot of Money for My Kid’s College Fund

Top 5 Money Myths Banks Want You to Believe

September 20, 2018

September 2018 Blog Post Collection

September 27, 2018Estimated Reading Time: 4 Minutes

The pressure to for save your kid’s college fund is everywhere! Saving for college seems to be what parents are “supposed” to do. But have you seen how much college is going to cost in 5, 10, or 15 years from now? Those prices are outrageous! If you are in a financial place to be able to pay for your child’s college education 100% in cash, that’s awesome and keep up the good work. Now the other 99% of parents that do not have the cash to pay for all 4 years of college…keep reading.

At the time of writing this, the cost of a private college tuition in 18 years will be over $300,000. With the current student loan crisis, it is no wonder why parents don’t want their children to feel that financial burden. I know it’s a lot of money, but I refuse to put myself in the poor house today to fund my child’s college fund for the future.

Saving for College

Saving for college can cause a lot of stress for parents. How much do we need to save for college? What kind of loans will we need to get? There are so many questions and not enough answers.

Since we have 2 kids, we must save for 2 college educations, which means we would need to have at least $200,000 saved in the next 10 years when my 7-year-old is going to start college. Hahahahahahahaha! Chances are that’s not gonna happen. So, I took a realistic approach to save for college that works best for me and my family.

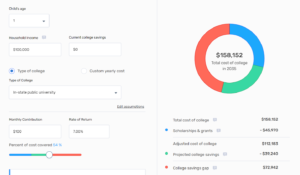

I started inputting our current information into a College Savings Calculator for each child. This calculator is one of my favorites because it gives an estimate of college costs, scholarships, and how much you will be over or under with your savings.

Below is a screenshot of the College Savings Calculator for a child who is currently 1 year old, planning for in-state tuition, and contributing $100 a month to a college savings plan.

In 17 years, assuming the child goes to college at 18 years old, we would have saved over $100,000 for their college fund. I would feel great about that! But it looks like we will be short about $73,000, and I am ok with that and here is why…

College Scholarships

Although this program estimated the amount of college scholarships and grant, that does not mean that they can’t get more. There are thousands, probably hundreds of thousands, of college scholarships and grants that are available for students. It takes work to apply for them (writing essays, gathering teacher recommendations, volunteering, etc.), but it is possible.

College scholarships are great to relieve the college financial burden since it is money that does not need to be paid back. There are college scholarships and grants available for minorities, military/veteran families, academic achievements, favorite hobbies, local students, and SO MUCH MORE! Almost anything you can think of they probably have a scholarship or grant for it.

Gift Money

My kids get cash from relatives for their birthdays, honor roll, and other special events. That cash goes straight to their college savings. An extra $150 to $200 per year in their college savings has the potential to grow to almost $6,000 in 17 years! Don’t underestimate the power of compound interest.

Student Loans

I refuse to sacrifice my retirement savings for my kid’s college education. What does retirement savings have to do with college savings? I’m glad you asked!

You might think I am selfish but remember there is no such thing as retirement loans. Student loans are not horrible. If you need to get one, get it. Just make sure it is a reasonable amount, and you have a plan to pay it back whether you get the loan for your child or your child gets their own student loan. $73,000 for a student loan is not bad considering that it costs $300,000 to attend college for all 4 years. Who knows, you might be able to pay that money in cash when the time comes. It is important to remember that you will not be in the same financial situation 5, 10, or 15 years from now.

Long Story Short…

I refuse to save a lot for my kid’s college fund because there are so many options out there for funding college education. Today, I am focused on paying bills, saving for retirement, and other important adult stuff. I don’t feel guilty about contributing 2% of our monthly income to college savings and you shouldn’t either. Savings something is better than saving nothing no matter how soon your child will be in college.

On a scale of 1-10, how confident are you about the amount of money you save for your child’s college fund?

As always, if you enjoyed this post please share with your friends and family so they can benefit too.

6 Comments

You may want to rethink some of your reasons for not saving for college, especially the scholarship part. The calculator you used already showed the amount your kids are likely to get from the college, which is by far the largest source of scholarship money. All those other scholarships you hear are out there just waiting for kids to apply aren’t likely to make much of a dent in tuition. Most are in the $500 to $1000 range. If you live in a state that has a generous state merit aid program, those scholarships can help significantly. However, if you live in any other state, if you are the type where you think you won’t qualify for need based financial aid, then you need to be prepared to pay for at least the cost of attending your state university. And given the uncertainty of the demand for jobs, borrowing anything more than the federal amounts, is probably not a good idea. http://www.diycollegerankings.com/truth-about-scholarships/7074/

Hi Michelle, thanks for the insight! I agree that scholarships have the possibility of not impacting the total cost of tuition. I had almost $60,000 in student loans when I graduated but as long as parents do their best and save what they can is what is important. Thanks for visiting!

There are so many ways to pay for college. Breaking the bank for our kids is nota good idea. Anyone that pays $300,000 to attend college – without becoming a doctor is crazy.

College will become less needed and costs will decline. Supply will soon surpass demand.

Great article! Hold the line

Thank you!

Yes to all of this! We don’t save much for our kids (we do put gifts from family, etc., in their accounts). I suspect that we will be able to cash flow whatever they need for college, but managing our own retirement first is most important. You didn’t mention it in the list, but the GI Bill is an excellent way to pay for college; my husband and I were both in the military for 4 years and got the GI Bill. It paid for everything up to the last semester of my doctorate, as well as a bachelor’s degree for my husband. There are SO many options out there to spend less on school.

That’s great to hear about the GI Bill. We have the GI Bill as an option but too scared to rely on it. Hahahaha. We still have 10 more years until my daughter goes to college. Who knows what we will have by then. Thanks for sharing your story!